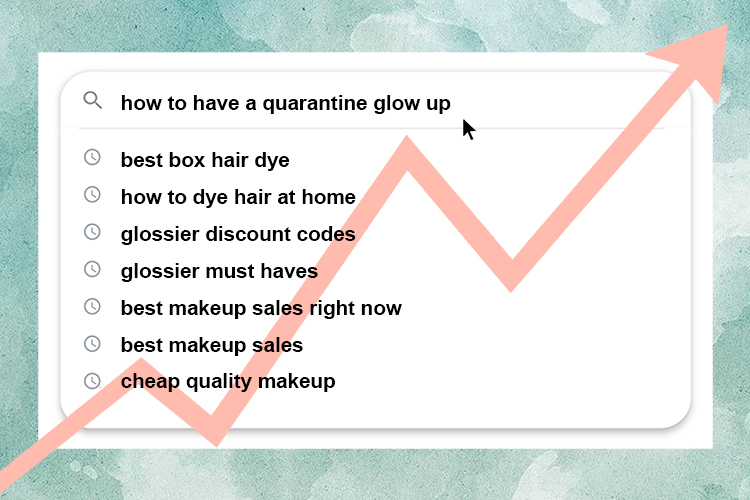

Online Beauty Sales Skyrocket During COVID-19 Pandemic

Graphic by Bailey Richards.

At a time when Americans are dealing with unprecedented levels of stress due to the novel coronavirus, consumers have been buying products that keep them distracted, entertained and relaxed. The online beauty industry’s sales in particular have skyrocketed as a consequence of these coronavirus-inspired spending habits.

The COVID-19 outbreak has resulted in an abrupt change in lifestyle for many Americans. All across the nation, states have issued emergency stay-at-home orders in a panicked effort to slow the spread of the disease. Students who used to learn in classrooms are now turning to Zoom and all ‘non-essential’ workers have either been furloughed or forced to work from home.

According to the NPD Group, a company that analyzes and predicts market trends, there was a 47% increase in online beauty sales in the first week of April alone. In the midst of a recession with unemployment rates rivaling those of the Great Depression, this increase in sales of a non-essential industry is unusual.

Behavioral economist professor John Doughtery from Loyola University Maryland said that he has not studied a similar sales increase from any industry at this level before. “These trends are almost always in a local context,” according to Dougherty. “As far as I can remember, there were no widespread consumer panics that looked like anything we’re seeing today.”

Dougherty attributed the trends in online beauty sales to the uncertainty consumers are facing in their lives. The ambiguity of what the future holds causes consumers to act extra risk-averse. This means that consumers will generally stock up on products — essential and non-essential — that they feel are important in order to maintain some control over their lives.

Kristina Durante, a business psychology professor from Rutgers University, specializes in consumer trends in the beauty industry. Her work — studying women’s consumer habits during the 2008 Great Recession — gives her valuable insight into today’s consumer trends.

“Any sort of beauty-enhancing product is predicted to run counter-cyclical to recessions,” Durante said. “So whenever we get the news that things are bad, that there’s uncertainty and scarcity, one of the things we know is products that are foolproof are these beauty enhancement products.”

Durante believes that the combination of a pandemic and a looming recession has triggered this same unconscious fear response in consumers today, driving sales of beauty products to these especially high rates.

Kiara Blanchette, a 21-year-old beauty influencer and founder of the blog Twenty Nothing, has seen firsthand these psychological motivators in her audience.

“With the heightened stress, I feel like people are trying to find an outlet to release that or take care of themselves in ways that are kind of aligned with what they see on the internet or in the world,” Blanchette said.

Image via Pexels

Blanchette also believes now that people have extra time on their hands, they are interested in trying new products, switching up routines and improving their outer appearance — all things that consumers could have been too busy to do before.

“People now have this abundance of time, and they're interested in figuring out how they can fill that time with things. So one of those things is like learning how to take care of their skin and learning how to do things that they might have felt they were too busy to do,” Blanchette said.

One product’s sales trend in particular, boxed hair dye, represents the increasing popularity of a self-care activity many would otherwise do in a salon. In April 2020, hair dye sales more than doubled based on data recently released by The Nielsen Company, a consumer research group.

Jenna Reichelt, a 20-year-old hairstylist from New Lenox, Illinois, explained that since salons in the state are closed, many of her older customers have been buying box dye to cover up their grays. Reichelt also acknowledged that for many consumers, dyeing one’s hair is a fun activity to cure cabin fever. “Since no one is able to change what the world is going through regarding the outbreak, people start to look for things they can change and control such as their hair color,” Reichelt said. However, consumers are not likely acting completely unilaterally in their spending on online beauty products. Many beauty companies have been using sales tactics to profit off of the consumer’s emotion-driven response to buy products that will make them feel good.

For instance, MAC Cosmetics’ COVID-19 statement emphasizes the power that using makeup can have during these stressful times. Their statements include, “There’s nothing more important to us than your health, well-being, happiness, and being able to brighten your day,” which contributes to a customer's feelings of community and care they would feel buying from MAC.

Mintel Group Ltd., a market analyzing company that projects future consumer behavior, suggested to industry experts in their April 15 press release that beauty businesses should market on the virus outbreak. They suggest tactics like using facemask-clad models in ads and marketing sweat-proof foundations for wearing under masks.

Glossier Inc., an online beauty brand popular with millenials, has already begun to capitalize on this advice. For instance, the company used quarantine to help market their latest hand cream. They released a video compilation that features quarantine activities fixated on hands, like painting nails, making food and moisturizing with Glossier Hand Cream. The ad is narrated by a mother’s voicemail to her daughter whom she cannot see because of the virus, which heightens the emotional impact of the ad.

Such advertisements are direct evidence of the sort of business behavior that Kristina Durante spoke of: during times of uncertainty, companies will take advantage of emotional responses and use them as an opportunity to market their products as an antidote.

But not all those involved in the beauty community have used the pandemic as a way to boost profit. For instance, Blanchette has taken a break from her usual posts on beauty trends and has tried to take a more mindful approach to her content creation.

“I'd say I personally have taken a step back from wanting to create beauty content because it just doesn't feel in touch with what's happening right now,” Blanchette said. “It mostly affects me in the sense of just trying to pivot my content to what is currently relevant.”

Although some may disagree with a company's effort to profit off of the pandemic, the recession caused by COVID-19 has left many beauty businesses desperate as they face mass profit loss or permanent closure.

As for when consumers can expect to shift their spending away from the beauty industry, that is just as uncertain as what life will look like after the coronavirus.

“I can see a very severe recession where it takes a long time for employment to come back and things like that,” Dougherty said. “But hopefully in the long run things will go back to normal.”

And once things go “back to normal,” Dougherty believed that consumers will feel more confident and their consumption habits will begin to reflect what they once were.

Whatever the future holds, it is evident that the online beauty industry’s unexpected role in helping consumers navigate their mental and physical wellness during this stressful time will not be forgotten.